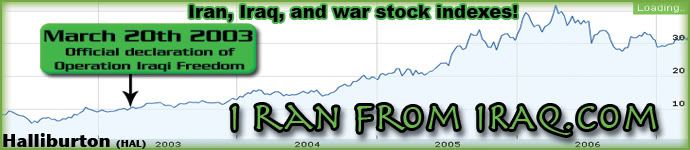

If the Bush Administration's plan to bring democracy to Iraq did not work as well as we all hoped, why not give them another chance in Iran while the administration still has time before the 2008 elections. Construction companies would hire more people for large scale military facilities commissioned within Iran and Defense Contractors would be receiving new contracts for the necessary hardware to carry out an invasion of a country much larger than Iraq. If a second large scale nation building attempt is already under way, which appears to be the case, than why not find which companies will have their 3rd or 4th quarter revenue boosted this year by another war? Whether or not you would be for or against a military invasion of the largest Democracy in the Middle East, there is no doubt there will be money to make.

It's no secret which companies profit directly from military build up and strategical attacks. If every American who can trade stock, roughly 30% of us, were to preemptively purchase 100-1000 or so shares of stock well diversified in a War Profiteer Index and sell our shares collectively once we become dissatisfied with the progress of the war we would literally be voting with our dollars. This could force the the privatized military sector to pay us all our shares which would drain their funds and potentially cripple their operations. I propose a solution for the terribly inefficient war market; A Preemptive Invasion Mutual Fund with holdings diversified in oil, defense, and construction companies. Even if the majority of funding for these corporations comes directly from the Federal Government, there is still the possibility for domestic and even foreign markets to have direct financial control over them. The $1.2 trillion spent so far on the Iraq war is only half of Fidelity Investment's $3 trillion in assets.

No comments:

Post a Comment