Wars, as we all know, create booms both physical and economic.

To get some perspective on this matter, let's take a look back to the year 2003 when Oil war II was just beginning. During this time there was a sudden demand for specialized services to fulfill the needs of the U.S. Government's wartime activities and this demand could be supplied by certain U.S. Defense and construction companies. Since part of the plan was to use Iraq's own oil revenue to rebuild itself after Operation Iraqi Freedom, our major oil companies and our Allies' would do their part accordingly and help out in the process. For their valiant efforts they might have even received some added benefits from that much needed help that they supplied us with!

As a U.S. citizen you are entitled to not only political but economic democracy as well and encouraged to own shares of stock in our beloved U.S. cooperations to further our nation's sense of Capitalistic Democracy. Since operation Iraqi Freedom was of course intended to benefit us all, Americans had and still do have an opportunity to actively participate in this spirit of financial independence bundled free with the War on Terror.

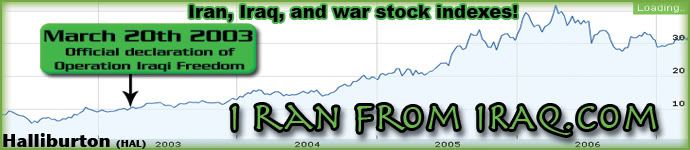

To demonstrate this, here are some simple charts showing just the stock prices of some 10 major cooperations involved in military contracting, construction, and Oil production from before 2003 to the present.

Construction Companies:

Halliburton and Caterpillar

Oil Companies:

Exxon Mobile, Chevron, Shell, and British Petroleum

Defense Contractors:

Lockheed Martin, Northrop Grumman, Rockwell Collins, and General Dynamics

Wow! These companies seem to have performed very well after from March 2003 even till today as we continue to stay the course in Oil War II. I wish I would have bought some shares before March 20th, don't you?!

Now let's get a an individual view of these companies financial standings evaluated through their stock prices from 2003 to the present...

#1 Halliburton Energy Services (HAL)

#2 Caterpillar Inc. (CAT)

#3 Exxon Mobile Corperation (XOM)

#4 Chevron Corperation (CVX)

#5 Royal Dutch Shell plc (RDS.A)

#6 British Petroleum plc (BP)

#7 Lockheed Martin Cooperation (LMT)

#8 Northrop Grumman Corporation (NOC)

#9 Rockwell Collins Inc. (COL)

#10 General Dynamics Corporation (GD)

Looks like some winners to me! But it is quite the shame that I hadn't heard from anyone I know personally making any good returns over the last few years investing with any of these companies. It would be nice to get a cut of this wouldn't it? Maybe it's not too late, and maybe, just maybe there will be another opportunity for these types of returns, and maybe it will happen this year!

Perhaps the perfect exit strategy from Iraq is just shifting operations towards the East, and marching into Iran. I guess you would need an entrance strategy for this plan. Oil War III, just think of the potential earnings! Remember that war creates all sorts of booms, but in the least I would pray it would give these brave companies the same percentage gains that they received during Oil war II.